Finmates

UI/UX

Raleigh, USA

Design Thesis for Graduation

Duration:

8 Months

My Role:

I led the end-to-end design and research process for Finmates , from identifying user needs through in-depth interviews and thematic analysis, to defining the product strategy, crafting user flows, and designing high-fidelity prototypes. I developed the core framework that aligned emotional, cultural, and behavioral insights into actionable UX decisions, and conducted iterative usability testing to refine the solution. I also applied principles from behavioral psychology and culturally responsive design to create a system that is both empathetic and functionally robust.

Research Question

Finmates is a personalized financial literacy app designed to support international students in navigating complex financial systems, emotional spending, and culturally unfamiliar money habits. Through goal-based planning, adaptive education, and real-time decision support, the app empowers users to build long-term financial confidence while evolving with their personal growth.

How can design of a personalized financial tracking system, incorporating user financial history and real-time data, empower international students to adapt to changing financial goals while improving their financial literacy through tailored guidance and resources over time?

Problem

International students face significant financial instability as they navigate unfamiliar systems, fluctuating expenses, and complex tax structures, compounded by a lack of culturally responsive, personalized financial tools — limiting their ability to make informed decisions, adapt to evolving goals, and maintain overall well-being and academic success.

Solution

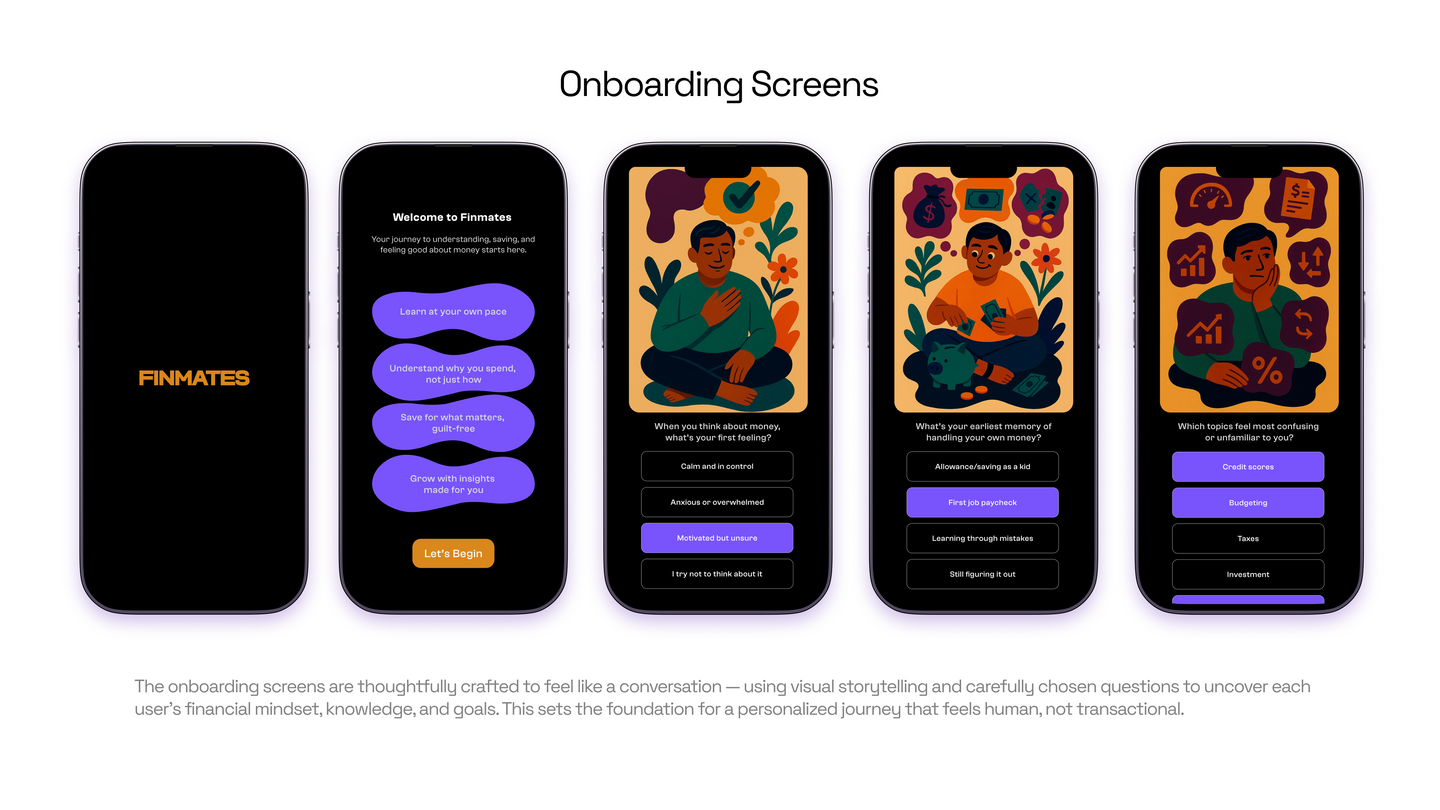

Finmates is a personalized financial literacy app designed to help international students confidently manage money while adapting to unfamiliar financial systems. The app combines goal-based planning, real-time AI-driven spending alerts, and phase-based learning modules that evolve with the user’s financial maturity. Through culturally responsive design and emotionally aware nudges, Finmates empowers students to build lasting financial habits, reduce uncertainty, and move toward long-term independence.

The process in phases

The Scenario

Aarav, a graduate student from India, arrives in the U.S. excited but quickly finds himself overwhelmed by unfamiliar banking systems, hidden fees, and pressure to manage everything on his own. His budgeting apps feel disconnected from his reality, and advice online is often confusing or irrelevant. That’s when he turns to Finmates — a financial companion that helps him set personal goals, sends culturally aware reminders, and breaks down financial concepts into digestible, timely prompts. Over time, Aarav builds confidence, starts saving intentionally, and begins seeing money as something he can control not just survive.

Positioning Statement

Finmates is a personalized financial literacy app designed for international students navigating money in a new country. By combining culturally-aware content, goal-based learning, and thoughtful AI nudges, Finmates helps students build confidence, form sustainable habits, and take ownership of their financial journey without the overwhelm.

Sub Research Questions

Goal-Oriented Financial Planning

How can a goal-setting assistant designed to encourage international students to set personal financial goals and share their motivations and align them with personalized advice and recommendations?

Visual Tools for Financial Understanding

How can a personalized financial visualization break down budgeting, investing, and saving concepts to enhance international students’ decision-making and understanding?

Risk-Responsive Financial Decision

How can interactive decision-support alerts, delivering real-time guidance, help international students identify and manage financial risks, such as overspending or loan repayment challenges?

Adaptive Financial Education Strategies

How can a recommendation engine tailor financial education to match international students’ current knowledge and capabilities, preventing content overload?

Research categories

This work is grounded in research that spans financial behavior, cultural context, and emotional design. From the psychology of money to gamified learning models, these categories shaped the lens through which Finmates was designed ensuring it’s not just useful, but truly resonant.

Financial Literacy for International Students

Challenges and needs of international students in unfamiliar financial systems, emphasizing access, guidance, and cross-cultural adaptation.

Behavioral Economics & Financial Decision-Making

Understanding how users make financial choices, including the role of cognitive biases, emotional triggers, and decision heuristics.

The Psychology of Using Money

Exploring emotional associations with money (guilt, anxiety, pride), financial identity, and how money is intertwined with self-worth, upbringing, and values.

Culturally Responsive and Emotionally Intelligent Design

Designing systems that reflect users’ cultural values, emotional states, and lived experiences to build trust and increase engagement.

Literature Frameworks

The literature matrix offers a focused synthesis of interdisciplinary research across financial literacy, adaptive learning, behavioral economics, and emotional design. It highlights how AI-driven personalization, culturally responsive tools, and psychological insights can collectively address the evolving financial needs of international students. This matrix reveals the connections between financial behavior, emotional well-being, and the structural gaps in current financial education—providing a foundation for designing more empathetic, intelligent, and effective financial learning systems.

Adaptive Learning

AI-driven systems that personalize financial education based on user needs and behavior.

AI & Financial Literacy

Use of virtual assistants, gamification, and analytics to enhance financial learning.

Behavioral Economics

Applying nudges, framing, and peer influence to improve money habits.

Financial Behavior & Well-Being

Exploring how self-control, mental budgeting, and financial literacy impact long-term well-being.

International Student Needs

Addressing cultural, economic, and institutional barriers to financial literacy for international students.

Research Frameworks

Conceptual Framework

The investigation plan maps research questions to a framework focused on international students’ financial literacy, starting with cultural and personal context to inform adaptive system design. Each question aligns with a stage in the process, aiming to improve literacy, decision-making, and long-term habits.

Goals for

the project

Establishing clear goals helped anchor the project in purpose and direction, aligning every design and research decision to a meaningful outcome. It ensured the solution addressed not just functionality, but emotional, cultural, and behavioral needs specific to international students’ financial journeys.

User Interviews

To get a deeper understanding of what international students actually go through when managing money abroad, I sat down with them for open, one-on-one interviews. The questions touched on everything from daily financial habits to banking frustrations, cultural barriers, and what they wished financial tools could do better. These conversations shaped the heart of Finmates—bringing real emotions, stories, and needs into the design, and helping me build something that felt truly personal and useful.

Real Stories,

Real Struggles

These insights emerged from interviews with 12+ international students, highlighting emotional, cultural, and behavioral barriers in financial decision-making. Patterns like spending guilt, credit fear, and misinformation shaped our design focus, grounding it in real user struggles.

Thematic analysis mapping

This map highlights key themes uncovered from user interviews about how international students manage their finances. It explores their challenges, budgeting habits, banking experiences, and expectations from financial tools—revealing a clear need for culturally adaptive, personalized systems.

Competitive Analysis

This page presents a comparative study of four leading financial apps—YNAB (You Need A Budget), Acorns, Goodbudget, and Greenlight—each chosen for their unique approaches to budgeting, saving, and financial literacy. These UX case studies helped uncover best practices in habit formation, data visualization, and user engagement, while also revealing critical gaps in personalization, cultural relevance, and educational support—especially for international students navigating complex financial ecosystems.

This expanded competitive matrix breaks down 12 financial apps based on their target users, UX goals, core features, strengths, weaknesses, design language, and accessibility considerations—offering a holistic view of how each product approaches financial education, autonomy, and inclusivity for diverse age groups, especially families, teens, and beginners.

SWOT Analysis

and Empathy Map

SWOT and empathy mapping helped me distill patterns from interviews into clear emotional drivers, needs, and barriers. These tools clarified user mindsets and priorities, guiding focused, relevant design decisions grounded in lived experience.

User Persona

Creating user personas grounded in interview data helped transform abstract insights into tangible user archetypes. These personas captured key emotional drivers, cultural influences, and decision-making behaviors of international students. They became a shared reference across the design process—guiding content tone, feature prioritization, and the overall user journey to stay aligned with real-world needs and constraints.

Persona Spectrum

This expanded competitive matrix breaks down 12 financial apps based on their target users, UX goals, core features, strengths, weaknesses, design language, and accessibility considerations—offering a holistic view of how each product approaches financial education, autonomy, and inclusivity for diverse age groups, especially families, teens, and beginners.

Journey Map

The user journey shows that financial literacy for international students isn’t a one-time lesson—it’s an evolving process. Students like Aarav face shifting challenges, from basic banking to credit-building and long-term planning. A responsive system should offer personalized insights, proactive guidance, and structured learning. With AI-driven tools and support that grows with the user, the goal is to build lasting confidence and financial habits that extend beyond graduation.

The core idea

The core idea of the system is that financial learning is not static—it evolves alongside a student’s financial journey. The education aspect is designed so that what a student learns today directly shapes and refines their financial decisions in the future. This approach ensures that financial literacy is not just theoretical but actively applied and continuously adapted as students navigate different life stages.

The key features

Learnings

Working on Finmates taught me that financial literacy isn’t just about numbers—it’s deeply emotional, cultural, and often overwhelming, especially for international students navigating a new system. I learned how important it is to meet users where they are, not just with information, but with empathy and timing. Designing with evolving needs in mind—rather than assuming a fixed user state—helped me think more adaptively, and pushed me to build a product that could grow with its users, not just teach them.

Wider Implication 1

As users mature financially, the app evolves to guide them in setting up long-term wealth strategies — from first investments to building generational wealth — showing how today’s tiny wins scale into tomorrow’s freedom.

Wider Implication 2

Develop a dynamic cultural intelligence system that not only translates money concepts, but also surfaces region-specific financial rituals, taboos, and emotional triggers — creating hyper-contextual learning paths across borders.

Wider Implication 3

Expand FinMate into a smart integration engine that connects seamlessly with users’ existing bank accounts, credit systems, and digital wallets. By syncing in real-time with institutional data, it offers hyper-personalized insights, flags risky patterns early, and bridges the gap between traditional banking and emotionally intelligent financial guidance.